Which securities frameworks are most widely used for security token offerings and how do they compare with one another?

By Vanessa Malone

Background

We like to think of security token offerings, or digital securities offerings, as the next generation of securities. Unlike cryptocurrencies or utility tokens, digital securities represent real ownership interests in an underlying asset or company. Using a smart contract, a self-executing contract powered on a blockchain, issuers can offer an array of financial rights to an investor including equity, dividends, profit share rights, voting rights, buy-back rights, etc.

A series of events led to the birth of security token offerings.

On the traditional side of securities, it all began with the Jumpstart Our Business Startups (JOBS) Act signed into effect by President Obama in 2012. From there we saw the emergence of Rule 506(c) of Regulation D (Reg D) and Regulation A+ (Reg A+) which came into effect in 2013 and 2015, respectively.

These regulations sparked an investing revolution. On one hand, companies were given the ability to utilize modern forms of communication and marketing (e.g. social media) to attract investors. On the other, investment opportunities typically reserved for high-net-worth individuals were now accessible to the general public, both accredited and non-accredited investors alike.

In parallel on the blockchain-sphere, the ICO boom of 2016–2017 happened. After the regulators’ verdict that most of these initial coin offerings were in fact unregistered securities offerings and needed to stop, two things happened. 1. Blockchain companies began to orchestrate offerings within the realm of today’s existing securities framework. 2. Companies realized that blockchain technology underlying Bitcoin and Ethereum had the ability to bring transparency, efficiency, and potential liquidity to existing securities offerings.

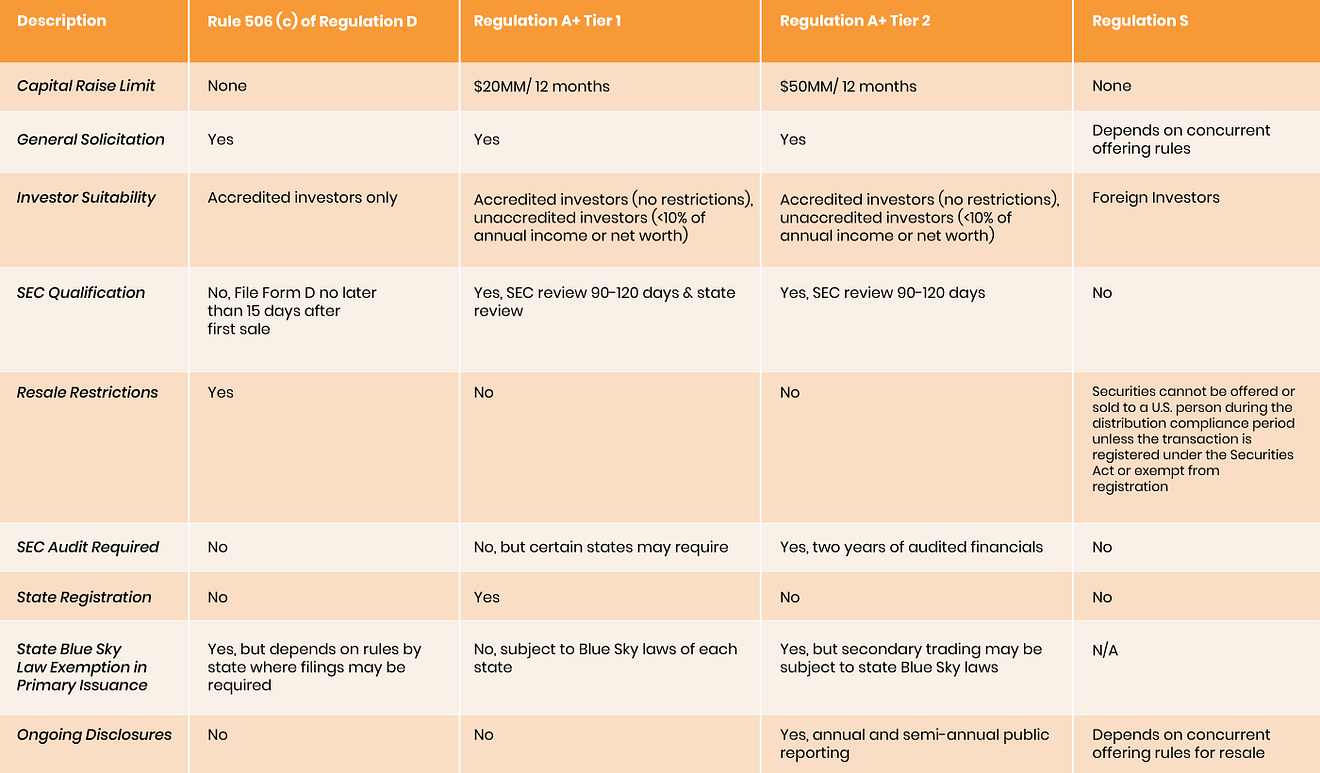

That said, we’ve developed a chart to help issuers navigate the most common securities exemptions used today for offering digital securities and how they compare.

Quick Notes on the Exemptions:

Rule 506 (c) of Regulation D

This rule allows issuers to raise an unlimited amount of money from accredited investors subject to applicable rules and conditions. General solicitation is permitted just like in a Reg A+ offering, but only accredited investors may participate. This means that issuers need to take reasonable steps to verify that an investor is accredited which may include implementing Know Your Client (KYC), investor suitability, and Anti-Money Laundering (AML) implementations into the investment process. Also important to note that the securities are restricted which means they must obey any statutory holding period before being released to trade in a secondary market.

Regulation A+

Commonly referred to as a “mini-IPO,” Reg A+ offers issuers the ability to market their investment opportunity to both accredited and non-accredited investors. This newer vehicle for capital raising gives companies the ability to utilize modern forms of communication to turn their fans, customers, and the general public into investors using social media, ads, email, etc. We believe this method aligns closely with blockchain values especially by leveling the playing field for the everyday investor to participate alongside traditional high-net worth individuals. Plus, like a traditional IPO, there is no statutory holding period which means that the security can be listed and traded in the secondary market straight-away.

Regulation S

Issuers who want to offer their investment opportunity to foreign investors utilize the Reg S exemption. The offering must limit access to the offering only to non-U.S. investors persons. Issuers have been utilizing this exemption alongside another exemption to attract investors in the U.S. and globally.

Final Thoughts

Instead of traditional securities or digital securities, the future could present a world with no distinction, just securities on a blockchain as the next generation.

First we saw offerings using Rule 506(c)of Regulation D. Next we witnessed the Reg A+ milestone recently reached in July when Blockstack and YouNow became the first Reg A+ token offerings to be qualified by the SEC. Next, we could see S-1 offerings on a blockchain.

Horizon offers a one stop shop with tools from issuance through to secondary trading that were built to adhere to global and U.S. compliance standards. To learn more visit https://www.horizon-globex.com/. Stay in touch on Twitter & LinkedIn.

Disclaimer: The foregoing is not meant as legal advice. You should consult with qualified legal counsel before undertaking any securities offering.