By Vanessa Malone

This week we announced that our client Piemonte Holding, an A-rated Brazilian bank which develops and manages tailor-made investment products, has closed its R$ 66m (US$ 16.2m) private bond issuance and successfully completed the launch of a secondary market for the Piemonte “Smart Bond” on Ethereum using Horizon’s compliance, custody, and blockchain trading solutions.

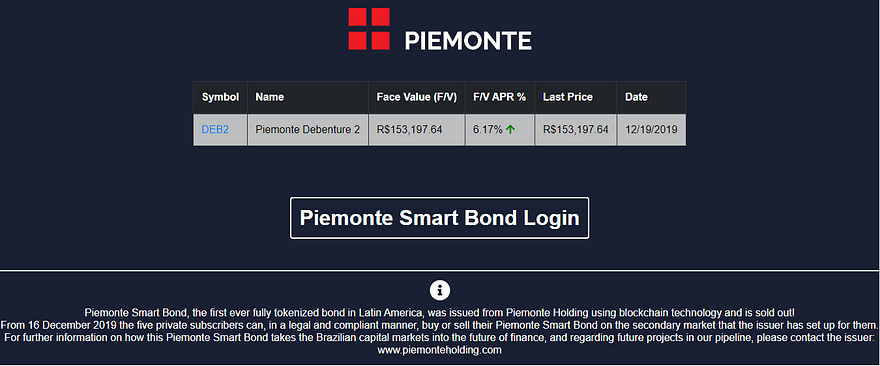

While most other blockchain bond issuances have been on private blockchains or part of an internal pilot program, this is the first bond issuance on Ethereum to include a public secondary trading platform for qualified subscribers to buy and sell bonds and offer liquidity potential prior to bond maturity. A glimpse into the live marketplace can be found at https://piemontetrading.com/.

This is the first live marketplace powered by Horizon’s blockchain trading technology, and unveils the potential blockchain technology has in revolutionizing historically illiquid markets such as the bond market.

Bonds are loans an investor makes to an issuer in exchange for the return of their investment plus interest at the end of the bond’s maturity. Typically bonds are issued by large corporations or governments and the cost of entry restricts access to institutions or ultra wealthy investors: short-term bonds are typically held for 1–3 years, medium-term bonds 4-10 years, and long-term bonds could be greater than 10 years (incharge.org). Bonds are seen as a long term investment and are generally classified as illiquid.

Unlike stocks, most bonds are not traded on exchanges in the secondary market. Instead, bonds trade over-the-counter, which means investors who wish to buy and sell bonds in the secondary market have to turn to bond dealers or their own network to participate.

This over-the-counter method also means limited price transparency, market makers, and more time trying to track down someone willing to purchase a bond. And while some moves are being made to modernize the bond market with technology, Piemonte’s blockchain-based trading venue highlights what we believe to be a bright future for the bond market.

In Piemonte’s $16.2m fully subscribed issuance, there were originally five bond holders. Now, using Piemonte’s bond exchange powered by Horizon’s blockchain trading technology, these holders can now trade their Smart Bonds amongst other qualified Piemonte clients prior to the bond’s 10 year maturity date.

Using Ethereum smart contracts, the Piemonte Smart Bond is transparently priced on an “adjusted face value” basis aligned with the U.S. Dollar and Brazilian Real exchange rate, as initially pegged on the bond issuance date of August 19th. Furthermore, Horizon’s dynamic pricing service contemporaneously adjusts the bond’s U.S. Dollar market value to apply the 3.50% annual coupon pro rata from issuance date to accurately value the bond on the secondary marketplace.

While this blockchain bond issuance was focused on offering liquidity prior to bond maturity to its private, qualified subscribers, Piemonte hopes to open blockchain bonds to the general public via fractional bond ownership in the future. We are thrilled to have worked alongside Piemonte to bring their compliance-focused bond market concept to fruition.

Read the full press release here: http://bit.ly/Piemonte_Horizon

To learn more about Horizon’s one-stop-shop for digital securities, please visit https://www.horizon-globex.com/.